Gov. Brown's 2017-18 May Revision Summary

May 15, 2017

by Martha Alvarez, ACSA Legislative Advocate,

On Thursday, May 11, Gov. Brown released the May Revision to his 2017-18 January budget proposal, delivering mixed news for school districts and community colleges who have been monitoring the updated monthly revenues flow into the State Treasury for the 2016-17 Fiscal Year. The following is ACSA’s analysis of the K-12 education components of the governor’s revised budget proposal.

Overview

Governor Brown’s revised budget now estimates General Fund revenues have increased by $2.5 billion over the three-year forecast period (2015-16, 2016-17 and 2017-18), for an overall General Fund spending plan of $125.9 billion, with corresponding modest investments in K-14 public education. The budget proposes to fund the Proposition 98 minimum guarantee at $74.6 billion, an increase of $1.1 billion since January.

As it has become customary in the previous budget proposals, the governor calls for fiscal discipline and restraint while issuing several warnings of risks to the state’s economy. Governor Brown’s budget recognizes the historic volatility and fluctuations in public school finance largely because of the state’s over-reliance on personal income taxes (and capital gains) from its wealthiest taxpayers. As noted in the overview of the state’s revenue estimates, for the 2015 tax year, the top 1 percent of income earners paid nearly 48 percent of personal income taxes. As a result, the governor emphasizes there is a heightened “uncertainty” and “unpredictability” of our revenue system since changes in the income of the highest-earners would have a significant impact on the state’s revenues and the ability to maintain programs. The governor’s proposed 2017-18 budget seeks to achieve a balance between meeting some of the state’s priorities with ongoing resources, while recognizing the volatility of the state’s predominant revenue stream.

Some of the key aspects of the governor’s proposal include:

- $2.8 billion in new transportation funding from the recently enacted fuel tax increases

- Restoring $500 million in child care provider reimbursement rate and additional preschool slots

- Suspension of a provision of Proposition 98 over multiple years, resulting in more than $1.2 billion in reductions to the minimum guarantee

- Deferral in $1 billion one-time discretionary grants for LEAs until May 2019

State’s Fiscal and Economic Outlook

California Economy

Similar to the rest of the nation, this year the state’s economy continues to grow and improve. The administration’s economic forecast expects continued growth over the next four years for California. California’s unemployment rate dropped to 4.9 percent in March 2017, the closest it has been to the national unemployment rate (of 4.4 percent) since early 2007.

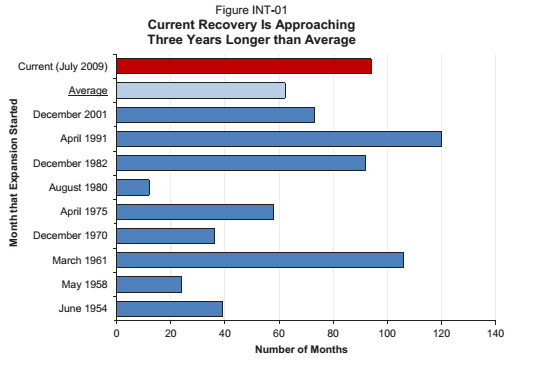

The administration notes that the state economy is in its eighth year of economic growth, which is three years past traditional expansions, as shown below. The current expansion has lasted since mid-2009, but the average length is only around five years. In addition, the Administration notes that there are several risks to maintaining the current economic expansion, including rising housing prices, disruptions to international trade, a stock market correction, or changes to federal tax or immigration policies. Any of these activities could cause revenues to drop or unemployment to increase. The Administration estimates a moderate recession could result in a reduction in state revenues of approximately $20 billion annually for several years.

Source: Department of Finance

Revenues

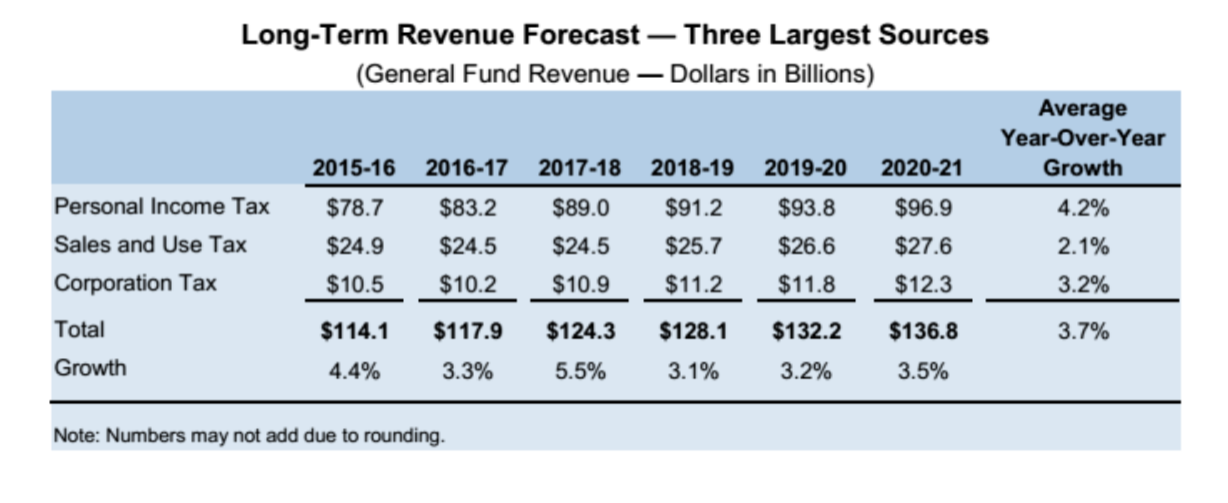

The budget estimates that revenues are expected to be $122.3 billion for 2016-17, and expected to increase to $124 billion for 2017-18. The governor’s long-term economic forecast shows revenue growth for the three major taxes – the personal income tax, the sales and use tax, and the corporation tax – increasing at a 5.5 percent rate in 2017-18 but slowing to 3.5 percent in 2020-21, translating to an average year-over-year growth rate over this period of 3.7 percent. Revenue growth for the three major taxes, which account for more than 95 percent of general fund revenues, is projected to reach $136.8 billion in 2020-21, as noted in more detail in the chart below.

The personal income tax forecast includes Proposition 30 revenues and $7.3 billion in 2017-18. These are higher than the Governor’s January proposal by $233 million and $411 million, respectively, as a result of higher capital gain taxes and improved market conditions.

The personal income tax forecast includes Proposition 30 revenues and $7.3 billion in 2017-18. These are higher than the Governor’s January proposal by $233 million and $411 million, respectively, as a result of higher capital gain taxes and improved market conditions.

Rainy Day Fund

The Budget Stabilization Account (Rainy Day Fund) approved by voters in November 2014 through Proposition 2 determines the minimum amount of debt payments and budget reserve deposits to be made in a fiscal year. Proposition 2’s requirements depend mostly on estimates of capital gains taxes, which are the most volatile of the state’s tax revenues. Proposition 2 also established a constitutional goal of having 10 percent of tax revenues in the Rainy Day Fund. By the end of 2017-18, the state’s Rainy Day Fund could have a total balance of $8.5 billion, or 66 percent of the constitutional goal of having 10 percent of tax revenues in the state’s reserves.

Education Budget

Proposition 98

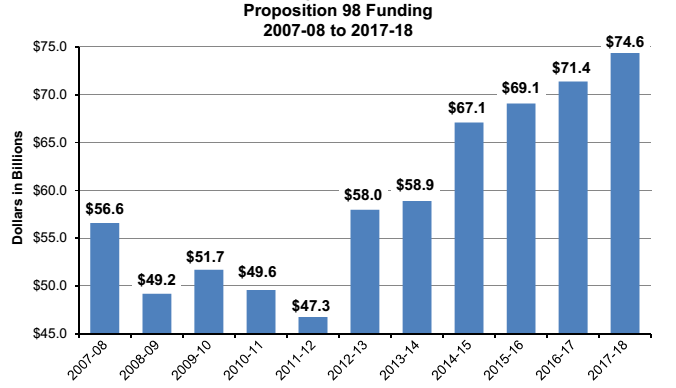

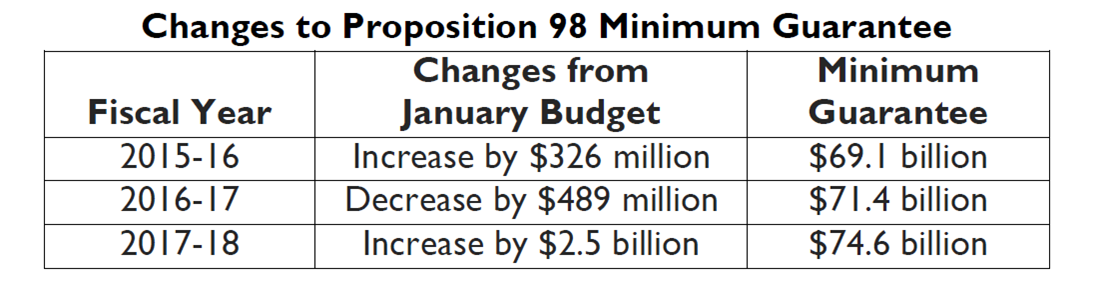

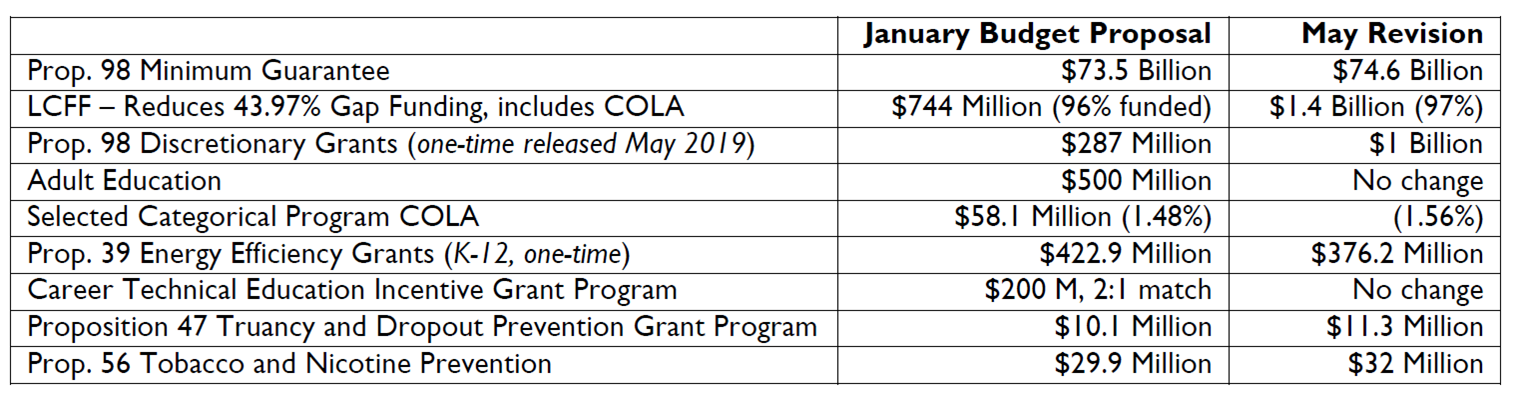

The Proposition 98 minimum guarantee is a complex formula that relies on General Fund tax collections, as well as other factors including average daily attendance, population and per capita personal income. In the January budget proposal, as a result of an estimated $5.8 billion reduction in General Fund revenues from 2015-16 through 2017-18, the Governor proposed reducing the minimum guarantee to avoid an over-appropriation, as well as a one-time short-term deferral of $859 million that would have been given to LEAs in addition to their July 2017 apportionment. While revenues are still lower than anticipated when the 2016 Budget was enacted, there has been a modest increase in revenues since the January proposal. The budget provides $74.6 billion for the 2017-18 fiscal year, an increase of $1.1 billion since January 2017 and $3.2 billion above the 2016 Budget Act. The following chart displays the evolution of Proposition 98 funding over the past decade. Reflecting the changes noted above to the minimum guarantee, K-12 per-pupil funding is estimated to be $4,058 in 2017-18 compared to the 2011-12 levels.

However, there are several key aspects of the Proposition 98 minimum guarantee that are worth mentioning since they will have an impact on school funding both in the short-term and long term. As a result of the higher revenues, the Governor proposes to eliminate the initially proposed $859 million, and is able to do so partially by over appropriating the guarantee by $432 million. While this may sound like a positive outcome for LEAs, the Governor seeks to generate savings to the General Fund by reining in the Proposition 98 minimum guarantee over the course of several years.

In an accounting gimmick that has not been pursued since the 1990s, the Administration proposes to suspend the statutory Proposition 98 Test 3B supplemental appropriation in 2016-17 and 2018-19 through 2020-21. If any of those years return to a Test 2, then the suspension would not apply. As described by the Department of Finance, this supplemental appropriation provision is a mechanism designed so that school funding grows at the same rate as the rest of the budget in years when economic growth is slower. Current estimates by the Department of Finance indicate this suspension could result in approximately $1.2 billion in reduced funding for K-14 over this five year period. The Administration assures that this or any amount owed to schools would be restored through future maintenance factor payments, an indicator of past reductions made to schools and community colleges. At the end of the 2017-18 fiscal year, the outstanding maintenance factor is projected to have a balance of $823 million that could potentially grow if the suspension of the Proposition 98 3B supplemental appropriation is approved. This suspension does not require a 2/3 vote by the Legislature, thus making it easier for the governor to pursue this funding reduction.

Local Control Funding Formula

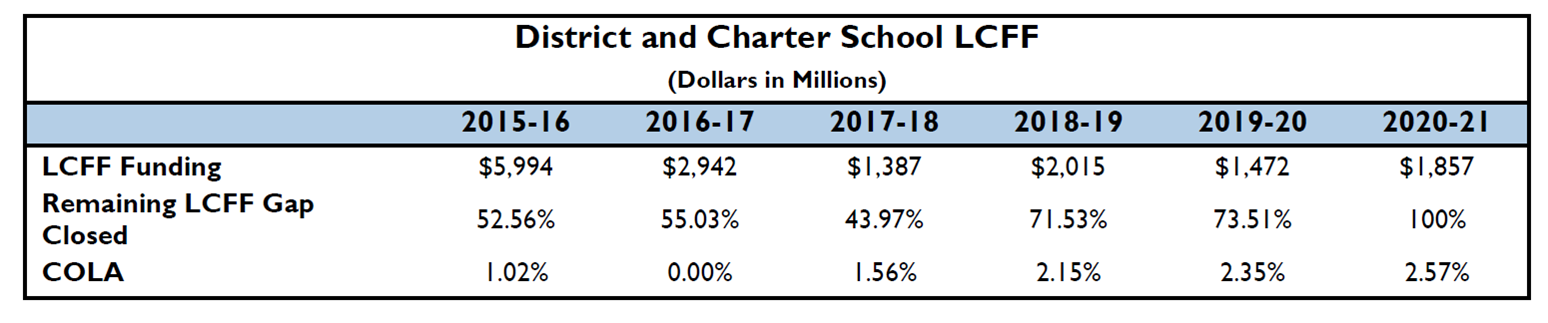

The May Revision increases funding for the formula by providing an additional $661 million in LCFF gap funding to school districts and charter schools, building upon the $744 million provided in the January budget. This $1.4 billion closes the LCFF gap funding by 43.97 percent in 2017-18 and brings the total formula implementation to 97 percent. The funding of LCFF stays consistent with the administration’s plan throughout the 2020-21 fiscal year, at which point LCFF is expected to be fully funded. It is important to note that the LCFF “funding target” of 100 percent is a moving target that will be adjusted whenever a cost-of-living-adjustment is applicable. With that said, the Department of Finance estimates there is less than $2.1 billion left to reach full implementation levels. Since Gov. Brown is termed out of office at the end of 2018, it is likely that he will continue to prioritize ongoing Proposition 98 funds towards LCFF. The administration’s projections for the remaining LCFF funding and Cost-of-Living Adjustments are as follows:

While county offices of education are seeking $20 million in continued funding to support their work with the implementation of LCFF and the new accountability system, the Department of Finance is not proposing an ongoing appropriation as they are still reviewing and analyzing workload needs.

Key Fiscal Provisions in the 2017-18 May Revision

The governor’s proposal manages to create room for some increased programmatic support with a combination of one-time and ongoing revenues. The following are the most significant education spending proposals:

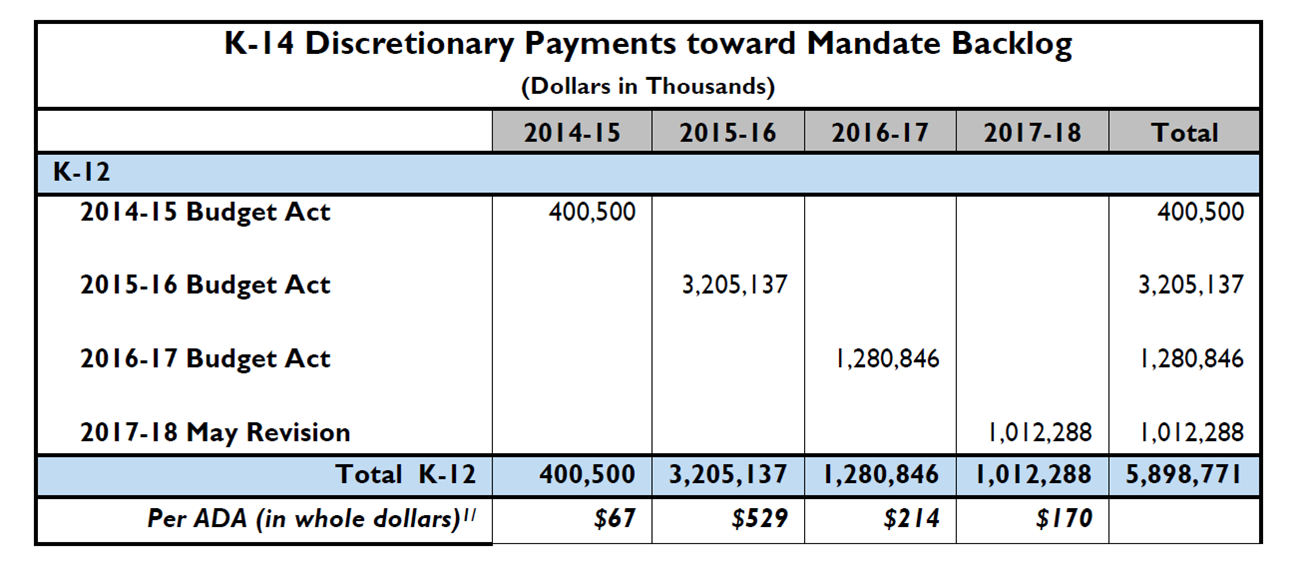

Mandate Repayment and One-Time Discretionary Funding

The revised budget provides a total of $1 billion in one‑time Proposition 98 funds, approximately $750 million more than the governor’s January budget, for school districts, charter schools and county offices of education to use at local discretion. However, while it has been a customary practice to distribute the funding to all LEAs on a per ADA basis, there is a caveat. The Department of Finance is proposing to delay the release of these funds until May 2019 in order to avoid an over-appropriation in the event the Proposition 98 minimum guarantee is lower in 2017-18. There will be a contingency clause added to trailer budget language at a later time to indicate this funding would be released to the extent that revenues for 2017-18 do not drop off. If there is an over-appropriation to Proposition 98, something the Department of Finance is trying to avoid, then that $1 billion in one-time discretionary funding would be reduced dollar for dollar to the adjusted minimum guarantee.

Once released, this funding distribution will be consistent with the approach initiated in the 2014 Budget Act, where one-time funding was provided for both general purpose activities and mandate reimbursements, whereby the funds would offset any applicable mandate reimbursement claims owed to LEAs. Upon release, these resources can be used to support such items as content standards implementation, technology, professional development, induction programs for beginning teachers and deferred maintenance. At this point in time the estimated per ADA amount is $170, but as discussed previously, the amount will be subject to changes in the Proposition 98 minimum guarantee during fiscal year 2017-18. With this appropriation, the outstanding mandate debt would be approximately $1.3 billion for K-12 schools.

There are many outstanding questions about this deferral in one-time funding, such as how LEAs should score these funds in their budgets and whether to count them as receivable; and whether this appropriation would be honored or reduced in the next budget year. The Legislature is also looking to use one-time funding for legislative priorities, which raises questions on whether any portion of this $1 billion may be negotiated for release of legislative priorities in 2017-18, or whether any portion of ongoing funding proposed for LCFF may be re-appropriated for one-time purposes.

Teacher Workforce Development

The Legislature has introduced more than a dozen bills aimed at addressing the teacher shortage challenges school districts are facing statewide. Most of the proposals come with a price tag and have been set aside pending budget negotiations with the governor – but the sheer number of bills suggests legislative leaders are serious about improving the teacher recruitment and retention pipeline. Both in the budget summary and in briefings, the Department of Finance acknowledges several initiatives funded in the 2016 Budget Act to increase teacher recruitment. Through the $35 million in one-time funding appropriated last year, the Commission on Teacher Credentialing has been able to leverage the funding for the following activities:

- A $10 million non-Proposition 98 General Fund appropriation resulted in 41 grants awarded to 33 public and private postsecondary institutions to develop or improve four-year programs that integrate a bachelor’s degrees and a teacher preparation program, with the goal of saving teachers an additional year of schooling to obtain their credential and $20,000 on average for this additional year of school.

- As part of a five-year $20 million grant program named the Classified School Employee Teacher Training Program, the CTC has awarded 24 grants to school districts and county offices of education to support 960 classified school employees to work towards earning a teaching credential.

- A five-year contract was awarded to the Tulare County Office of Education to create the California Center on Teaching Careers, with the goal to recruit individuals into the teaching profession by providing outreach and referral services, both online and at regional centers., The Center will launch online in July and regional centers will open before the start of the 2017-18 school year at the county offices of education in Los Angeles, Riverside, Shasta, San Diego, and Sonoma, Ventura and Sacramento counties. The Center may support public service announcements, employment referrals, the distribution of recruitment publications and information on financial aid and the availability of teacher preparation programs for prospective teachers, and outreach to high school students, college students, out‑of‑state teachers, and current credential holders.

In addition to these efforts currently in place, the Administration is proposing to leverage approximately $11 million in federal Title II funds to attract and support professional development of teachers, principals and other school leaders. The Department of Finance will release additional details in the coming weeks. It may also be the case that the State Board of Education may be tasked to come up with details as part of the Every Student Succeeds Act State Plan that is currently being drafted.

Early Childhood Education Program Flexibilities and Alignments

As a result of the lower than expected General Fund revenue growth projected at that time, the January budget proposed pausing increased provider reimbursement rates and additional 2,959 full-day State Preschool slots available on April 1, 2018. Due to the modest General Fund revenue increases since then, the May Revision proposes fully restoring this funding. Specifically, starting on July 1, 2017, the reimbursement rate will increase by six-percent for the State Preschool program and other direct-contracted child care and development providers. This pause in funding was a major objection by legislators in both houses, as well as by the Legislative Women’s Caucus.

Over the coming weeks, we may see members of the Legislature and early education advocacy groups shift their attention to an uphill battle to convince the Administration of the need to update the state’s income eligibility threshold to qualify for early care programs. The State Median Income was last modified in 2007, and as a result of the increased minimum wages in California since 2016, many families are no longer qualified for child care and preschool programs. ACSA is supporting Assembly Bill 60 (Santiago) that seeks to update the income eligibility to the 2014 levels, which is the most recent data on state median income published by the United States Census Bureau. As written, AB 60 would also enable families to receive childcare and preschool services for not less than 12-months before the eligibility was redetermined.

In addition to these funding issues, there are several policy proposals that will benefit school districts and county offices of education if they become enacted. Noting that funding for California’s pre-kindergarten education has historically been spread among a patchwork of programs and funding sources, the governor’s May Revision maintains proposed program flexibilities “that foster administrative efficiencies and better align child care and early childhood education programs to create a more rational system for both providers and the families they serve.”

Specifically, the budget trailer bill language proposes the following modifications:

- Authorizes the use of electronic applications for child care subsidies.

- Allow children with exceptional needs whose families exceed income eligibility

guidelines access to part‑day state preschool if all other eligible children have

been served. This allows part‑day state preschool providers the flexibility to

fill unused slots with other students who would benefit from early intervention

or education. - Align the state’s definition of homelessness with the federal McKinney‑Vento Act for

purposes of child care eligibility. Many providers receive both federal and state funds

and different definitions of homelessness can be confusing. - Commencing July 1, 2018, eliminates the Community Care Licensing (CCL) requirements as set forth in the Title 22 regulations for state preschool programs utilizing facilities that meet transitional kindergarten facility standards, specifically K‑12 public school buildings. The California Department of Education is being asked to conduct all the necessary changes and issuance of management bulletins prior to July 1, 2018. By providing the flexibility to use Field Act-approved facilities, LEA state preschool providers may be able to take up expansion slots by avoiding the delays in obtaining a licensing permit.

- Allow state preschool programs flexibility in meeting minimum adult‑to‑student ratios and teacher education requirements, allowing for alignment with similar Transitional

Kindergarten requirements. LEAs would be authorized to meet this ratio in one of three ways:- Classroom led by a permitted teacher, with a 1:8 adult-to-child ratio, a 1:24 teacher-to-child ratio, and a maximum group size of 24 students (current law).

- If a state preschool provider opts to use a credentialed teacher (rather than a permitted teacher), the program can utilize a 2:24 ratio model, for example, in which one teacher is credentialed and is authorized to provide instruction in Transitional Kindergarten classroom and meets the TK teaching requirements (24 units of early childhood education credits or the equivalent as determined by the school district), and supported by an aid or permitted teacher. The maximum group size is 24 students.

- Programs participating in the Quality Rating and Improvement System (QRIS) with rankings of 4 or higher, the program would not be subject to adult-to-student ratios beyond what is required to maintain a Tier 4 or higher rating.

- Authorizes school districts to operate kindergarten or Transitional Kindergarten classes for different lengths of time during the school day either at the same or a different school site without having to seek a waiver from the State Board of Education to deliver a Transitional Kindergarten program that has different instructional minutes from kindergarten programs.

- School funding mechanisms should be equitable, transparent, easy to understand, and focused on the needs of students.

- General purpose funding should cover the full range of costs to educate all students.

- School districts should be provided the flexibility to establish goals and design innovative ways of delivering services to all students.

- School districts are responsible for planning and implementing programs that lead to continuous improvement, measured by academic outcomes.

Career Technical Education

Enacted in the 2015 Budget Act, the Career Technical Education (CTE) Incentive Grant provides $900 million over a three-year period with $400 million committed in 2015-16, $300 million in 2016-17 and $200 million in 2017-18 to support transitional education and workforce development initiatives. The 2017-18 fiscal year will be the final appropriation for this grant program and, beginning with the 2018-19 school year, schools who received grant funding will be expected to support CTE programs within their LCFF allocations. While there are legislators who wish to re-establish a categorical program, it is unlikely that this governor would support the effort, particularly at a time when state revenues are lower than expected. In particular, Assemblymember Jordan Cunningham introduced Assembly Bill 445 to create a $300 million ongoing CTE grant program.

It is important to note that the 2016 Budget Act included trailer bill language to allow the state Superintendent of Public Instruction to annually review the CTE program expenditures of grant recipients, for purposes of verifying that the dollar-for-dollar match requirement of the CTE Incentive Grant Program was met. If the match requirement was not met, the language directed the Superintendent to reduce the following year’s grant allocation in the amount equal to the unmet portion of the match requirement.

Proposition 47 – Truancy and Dropout Prevention Grant Program

California voters approved Proposition 47 in November 2014, a ballot initiative that changed some non-violent drug and property charges from felonies to misdemeanors and established the Safe Neighborhoods and Schools Fund. The goal of Proposition 47 is to reduce the daily inmate population in California and prevent new admissions to the prison system, while saving money to be invested in K-12 truancy and drop-out prevention, victim services, and mental health and drug treatment. For 2017-18, the May Revise proposes $11.3 million ($10.7 million for grants and $565,000 for the program implementation) to programs that improve student outcomes, including K-12 truancy prevention and support for pupils who are at risk of dropping out of school or are victims of crime. These funds will be included in the Proposition 98 calculation, as the funds will be extended for direct services and other support for students.

In September 2016, Gov. Brown signed AB 1014 (Thurmond) and SB 527 (Liu) for the purposes of implementing the Learning Communities for School Success Grant Program. Earlier this spring the California Department of Education solicited requests for application from interested LEAs. While the deadline for last year’s funding appropriation has already passed, school districts and community organizations are encouraged to start identifying priorities for future grant awards. For additional details on program eligibility, visit http://www.cde.ca.gov/ls/ss/se/schoolsuccess.asp.

School Facilities

In November 2016, voters passed Proposition 51 to raise $9 billion for K-community college school facilities with $7 billion allocated to K-12. Language in Proposition 51 clearly prohibits the legislature from making any changes to the existing state school building program for projects funded from this bond. Approximately $2 billion in unfunded projects at the Office of Public School Construction will likely be the first priority for funding once bonds are sold.

While the Legislature is prohibited from making changes to the program, reforms can still be made through policy and regulation changes. The governor’s January budget referenced a 2016 state audit of prior school facilities bond expenditures and lack of transparency for use of these funds. In March, the Administration introduced trailer budget language, the Administration to require facility bond expenditures to be included in the annual K-12 Audit Guide. ACSA has joined the California Coalition for Adequate School Housing (CASH) and other education groups in expressing opposition to the Department of Finance’s proposed language that contradicts longstanding practices. For example, as written, the state would require school districts found to have spent state bond funds on unauthorized uses to repay these amounts directly from a district’s annual operating Proposition 98 apportionment, instead of allowing districts to choose the repayment source, such as local bond funds. The proposed audit language is also retroactive in that it applies to projects that receive funds after July 1, 2017, even though districts have incurred costs, and/or entered into contracts prior to that date.

In addition, the Administration has been working with the State Allocation Board and Office of Public School Construction to revise policies and regulations to “implement front-end grant agreements that define basic terms, conditions, and accountability measures for participants that request funding through the School Facilities Program.” It is anticipated the State Allocation Board will take action on the final grant agreement at their next meeting on May 24th. The Brown Administration has emphasized that the audit requirement and the front-end grant agreements will need to be in place prior to the issuance of any school bonds in fall 2017. In January, the Department of Finance indicated that the state will issue approximately $655 million in school bonds this fall. This amount would cover the unfunded list ($370 million) and the remaining $285 million could be used to process applications on the acknowledged list. ACSA believes this amount is insufficient to meet existing demand for bond funds, and over the course of the budget negotiations, we will continue to urge the Legislature to press the Administration to provide a schedule of future bond sales in order to address the backlog of school facility projects awaiting funds.

Special Education

Since February 2017, the Administration held several stakeholder meetings to gather input on the existing special education finance system and obtain feedback on the recommendations made by the 2015 Statewide Special Education Task Force and included in the Public Policy Institute of California (PPIC) November 2016 report on special education finance. The report found that state special education funding has not kept pace with the increase in students identified with special needs and the costs associated with providing specialized services. It also identified large funding disparities among Special Education Local Planning Areas (SELPAs) and recommends the state consider the future role of SELPAs since the current system does not align with LCFF principles.

The administration specified that these stakeholder discussions were consistent with the LCFF and apply to all students, including students with disabilities and center around the following principles:

To review the task force’s recommendations, visit the San Mateo County Office of Education website and view the PPIC report here. Given the significant concerns and opposition raised by stakeholders, particularly SELPA administrators, the May Revision does not include any proposed changes for the 2017-18 fiscal year. Instead, the Department of Finance anticipates continuing this discussion with stakeholders throughout the fall, with the goal of considering what special education funding could look like once LCFF is fully implemented. Depending on the outcome of future conversations, it is possible that the Administration could release a preliminary proposal in January 2018.

State Pension Contributions

The Administration notes that the state now has $282 billion in long-term costs, debts and liabilities, with a significant portion – $279 billion – related to retirement costs of state and University of California employees. According to the most recent figures, these retirement liabilities have grown by $51 billion in the last year alone due to lower-than-expected investment returns by the pension systems, as well as actions taken by the CalPERS and CalSTRS boards to adopt lower assumptions about future earnings. According to the LAO, for CalSTRS alone, the unfunded liabilities have increased by $21 billion.

Both the Administration and the LAO acknowledge the increased expectations for the state’s contributions to the pension systems. In a report released by the LAO in early May 2017, it is suggested that the state will largely bear the responsibility for covering the resulting costs. By 2023-24, it is anticipated that the state’s contributions will nearly double to $9.2 billion annually. In an effort to achieve long-term savings of over $11 billion in pension costs, the Governor proposes making an additional payment of $6 billion for state pensions, funded by a loan from the state’s short-term savings account. Combined with the state’s statutory contribution of $5.8 billion, the state will make close to $12 billion in payments in 2017-18 alone. This is equivalent to approximately 10 percent of the General Fund revenues. Unfortunately, this increased payment by the state will not have an impact in reducing school employer contributions.

While it is not anticipated that mitigating the increased school employer pension contributions will be a priority for either the Legislature or the governor, the Legislative Analyst Office reported in November 2016 on the impending increased pension costs rising through 2020-21. As noted in its five-year economic forecast, compared with 2013-14 levels, total district contributions to CalSTRS and CalPERS are anticipated to be nearly $6 billion higher annually by 2020-21. Given the magnitude of pension contribution increases, ACSA will continue to examine potential options to mitigate their impact on LEAs. The CalPERS and CalSTRS funds must be viable so the systems can pay out future retirement benefits, but their viability cannot be at the expense of student programs and services.

For additional information on the latest LAO report on pensions, visit http://lao.ca.gov/publications/report/3662.

Other K-12 Budget Adjustments

- Local Property Tax Adjustments — Due to lower offsetting local property tax collections, the General Fund contribution to Proposition 98 increases by $188.7 million in 2016‑17 and $327.9 million in 2017‑18.

- Proposition 39 Energy Efficiency Funding – The May Revise decreases the amount of energy efficiency funds available to K-12 schools in 2017-18 by $46.7 million to $376.2 million to reflect reduced revenue estimates. Since the Proposition 39 initiative only required an appropriation for five years, the 2017-18 fiscal year will be the last year that the Legislature is required to provide these one-time energy efficiency grants to school districts and charter schools. However, Senate President pro Tem Kevin de Leon has introduced Senate Bill 518 attempting to extend this grant program, although the funding would come at the expense of funding other K-12 education priorities.

- Adult Education – While not specifically mentioned in the governor’s summary, the budget continues support for adult education with approximately $500 million in Proposition 98 funds.

- Cost‑of‑Living Adjustments (COLA) – An increase of $3.2 million in Proposition 98 spending in selected categorical programs that remain outside of the LCFF for 2017-18 to reflect a change in the cost-of-living factor from 1.48 percent in the January budget to 1.56 percent at May Revision. These include special education, child nutrition, foster youth, preschool, American Indian Education Centers, and the American Indian Early Childhood Education Program. The COLA for school districts and charter schools are provided within the increases for LCFF.

- Average Daily Attendance (ADA) – An increase of $26.2 million in 2016‑17 and $74.1 million in 2017‑18 for school districts, charter schools, and county offices of education under the LCFF as a result of a smaller drop in ADA growth overall between those two years.

- Charter Schools – The Administration proposes to use program savings and increase the Charter Facility Grant Program rates from $7.50 to $12.36 per ADA since there has not been an adjustment to account for inflation since the program began in 2007. The increased rates would apply to all intervening COLAs.

ACSA Perspective

The May Revision results in mixed news for the K-12 education community, as we see modest increases to LCFF and a proposed over-appropriation to the Proposition 98 minimum guarantee in 2016-17 to avoid the deferral proposed in January. The education community understands the need for increased funding to support many of the local priorities identified through LEA’s Local Control and Accountability Plans and to address the rising costs to school and district programs. Over the coming weeks as districts finalize their 2017-18 budgets, it will be imperative that all of us remind both legislators and community members that the November passage of Proposition 55 maintains existing funding for our students. However, it does not increase funding since it does not go into effect until 2018-19 and it will not be until then that we know its benefits to the state budget. It is also important to note, for context, that K-14 education will once again be perceived as a “winner” in the governor’s proposed budget. The state faces additional cost pressures on the non-Proposition 98 side, with limited available resources to begin to address the hundreds of billions of unmet need. This unfortunate reality could surface as the education community amplifies the call for more adequate and long-term investments in K-12 public education.

It is important to remember that this is just a proposal, and there is another month before the 2017-18 state budget is finalized. The governor’s proposed budget and, more specifically, his commitment to fiscal restraint and resistance to new policy priorities from the Legislature will face both policy and budget committee scrutiny in the coming month. Over the next two weeks, the Senate and Assembly will pass budgets reflecting the priorities of the majority Democrats in the respective houses. A budget conference committee will be created through which the governor and Democratic leaders will then negotiate an acceptable budget. It will be during this phase that slight modifications to the governor’s budget will be discussed and agreed to by the both camps. Governor Brown has made it clear that after enactment of his LCFF reforms his commitment to resisting new programmatic spending obligations until state debt (both to schools and elsewhere) is eliminated is his highest priority. It is unlikely that the governor will be open to much movement on the creation of any new programs. The Legislature will act in time to meet the June 15th constitutional deadline and send a budget to the governor for approval. As we saw last year, that final budget will reflect the governor’s priorities—with a few exceptions to obtain the needed support from Democratic leaders in the two houses.

On the K-12 side, two main issues that will result in a robust discussion between the Legislature and the governor are his proposed suspension of the Proposition 98 3B supplemental appropriation and the deferred $1 billion in one-time discretionary funding until May 2019. To the education community, we view both of these accounting shifts as a reduction to Proposition 98 simply because the Administration is choosing to not overappropriate the minimum guarantee in the out-years. The Administration could argue that these proposals are necessary in order to avoid mid-year cuts in the event General Fund revenues are lowered than projected in 2017-18, as was the case in the current budget year. ACSA will focus our budget advocacy on preventing the suspension and the deferred $1 billion in one-time funding.

The Legislature may also raise concerns about the governor’s proposed alignment and flexibility proposals for the State Preschool Program. Private providers have been adamantly opposed to the Title 22 exemption for LEAs as they claim this would result in lowered quality standards and threaten the health and safety of children. ACSA is strongly supporting these flexibilities as we believe it will streamline duplicative program requirements and will give school districts options to blend State Preschool with Transitional Kindergarten if it makes sense for their local community.

The Legislature may attempt to redirect Proposition 98 funding to support legislative proposals seeking an earmark with ongoing and one-time funding for specific purposes. While all of these bills are making their way through the legislative process and being heard in policy committees, the bills are subject to a budget appropriation and would only become law if funding is provided. For example, for the ongoing funding requests, Senate Bill 78 (Leyva) would continuously appropriate $99 million more for the After School Education and Safety Program. The bill would also include an automatic COLA for future years. As costs of operating after school programs continue to increase, certain members of the Legislature consider it is time to increase the daily reimbursement fee from the existing $7.50 to $9 per student served. The challenge with providing after school programs and being able to sustain them will only increase as the state’s new minimum wage law of $15 per hour is implemented over the next six years. Another example of requests for an ongoing budget appropriation is Senate Bill 527 (Galgiani), which would include an automatic COLA for home-to-school transportation at an annual cost of $5 million to $10 million.

In regard to proposals for one-time funding, the Assembly is seeking a $5 million appropriation to support LEAs with a high influx of unaccompanied minors and refugee students. The Assembly is also pursuing $60 million in one-time funding to reinstate a teacher residency pilot program (Assembly Bill 1217, Bocanegra). Between the Assembly and Senate, close to a dozen proposals continue to seek funding to address the teacher shortage and improve the teacher pipeline from recruitment, to induction and ongoing professional development. Earlier this year, Assembly Member Rudy Salas introduced Assembly Bill 463 seeking a $5 million budget appropriate to re-instate the Assumption Program of Loans for Education (APLE), last funded in 2012-13 to encourage outstanding students, district interns, and currently credentialed teachers to seek and teach in specified K-12 teaching positions. The Legislature may also be interested in exploring the potential challenges with the implementation of Proposition 58 (bilingual education), which passed by California’s voters with overwhelming support in November 2016. This initiate does not go into effect until July 2017, yet school districts have started to raise concerns regarding the need for more bilingual education teachers, and additional funding for professional development and training for current teachers who do not have a Bilingual, Cross-cultural, Language and Academic Development (BCLAD) credential. Assemblymember Eloise Reyes is the author of Assembly Bill 952 to support the professional development of bilingual education teachers, while Assemblymember Monique Limon’s Assembly Bill 1122 would support dual-language immersion programs.

On the non-education side, it will not be a surprise if the California Legislature and the governor continue to direct their attention to the national political landscape, as there are several policies with significant fiscal implications that could negatively impact the state. These include an impending threat to repeal the Affordable Care Act that could cost the state more than $20 billion in federal subsidies and result in an estimated loss of 334,000 jobs, potential tax cuts to the highest income-earners as well as changes to immigration and climate change policies that could disrupt communities throughout California. The Legislature is also worried about California’s housing affordability, and because the governor is not proposing funding to alleviate increased housing costs, legislative leaders may continue to raise this as a priority.

In closing, public education is in the strongest position it has been in a decade and our students are the beneficiaries of the good work we’ve done in our schools, our communities, and inside the State Capitol. But ACSA acknowledges that there is more work to be done. As student advocates, ACSA believes the improvements and increases to funding are critical. In early January 2017, Education Week’s Quality Counts 2017 rankings listed California with a letter grade of F compared with a national average of D across the spending indicators. We must recognize that those levels are not enough to meet increased expectations and student needs. The governor’s Local Control Funding Formula has placed additional responsibility on local decision making which empowers all of us to be more effective leaders. It forces all of us to recognize the successes and challenges we have in our districts and how pursuing long-term investments to stabilize public education is crucial for current and future students.

As a major stakeholder, ACSA will be actively engaged in the budget discussions with the Legislature and the administration to ensure our best interests are upheld. Throughout this legislative season, ACSA will keep you apprised of all budget negotiations until the budget is completed in June.

ACSA welcomes our members’ feedback and questions on these and other issues. Please contact Martha Alvarez, ACSA Legislative Advocate, at for any clarifications related to the budget.